SuperInvite is often used to pay for FFO/Academies, or other mailings that qualify for tax deductions for childcare. In Superinvite, you have a separate report for this, making it easy to manage.

Slik you go frem:

- Edit the mailing that qualifies for childcare deductions and go to the “General Information” tab.

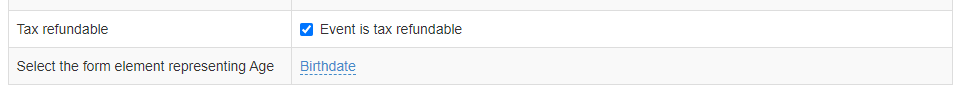

- At the very bottom of the page you will find the field "FFO deduction", where you tick it.

- Furthermore, you select which field in the registration form applies to "Date of birth". We need to know this, as only children under the age of 12 can write off childcare on the tax for them. Read more about the rules for deductions around childcare here .

- Once you have done this on all mailings that qualify for childcare deductions, go to the top of the page under “settings.

- Here you select "FFO deduction report, and choose which year you want the report for.

- Download the report. Here you will see all transactions that are eligible for deduction.

Note: It may be a good idea to ask for the national identity number in the registration form, as it may be easier to report to authorities directly. In the registration form, you can choose that the field relating to birth number is not sent in summary by email when they pay, and then in accordance with the GDPR guidelines on sensitive data.